Understanding Swiss Bank Minimum Balance Requirements

Swiss bank accounts have long been associated with privacy, security, and exclusivity. Opening an account in Switzerland involves understanding the requirements, benefits, and costs associated with this prestigious financial option. This blog delves into the intricacies of Swiss bank accounts, particularly focusing on nonresidents who seek to benefit from the robust Swiss banking system. We will explore the procedures for opening an account, dispel common myths about secrecy, and highlight the financial implications, including necessary minimum balances. Additionally, we’ll compare costs and feature a FAQ section to address common queries. This article serves as a comprehensive guide for anyone considering the advantages of Swiss banks, providing clarity and direction for potential account holders.

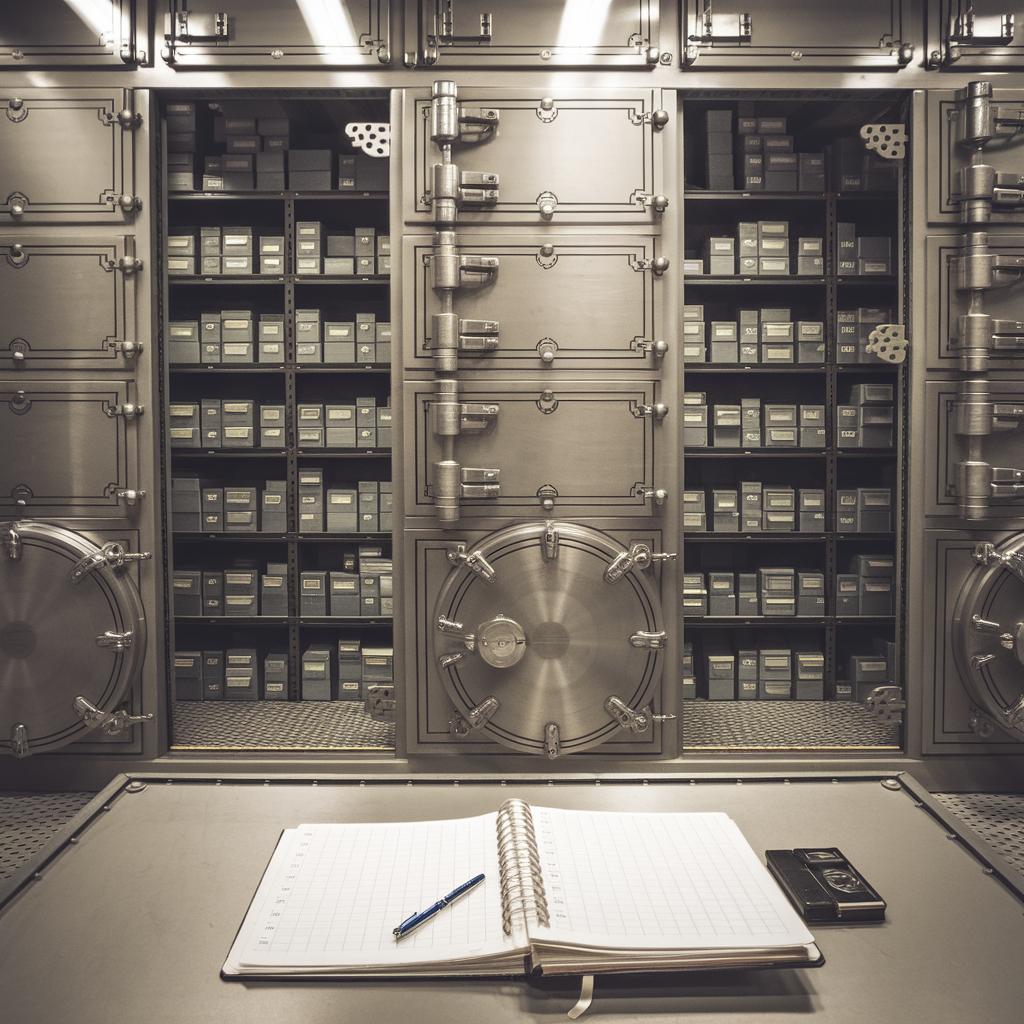

Opening a Swiss Bank Account

Opening a Swiss bank account is often perceived as a complex process, mainly due to regulatory requirements and the need for transparency. Most Swiss banks have specific criteria that applicants must meet, which can include providing proof of identity and financial documentation to verify the source of funds. These measures ensure compliance with international anti-money laundering regulations.

The procedure to open a bank account in Switzerland varies among financial institutions, and applicants might face stringent due diligence checks. While these checks are routine, they emphasize the importance of proper documentation. Digital advancements have streamlined this process, allowing some steps to be completed online, increasing convenience for potential account holders.

Swiss Bank Accounts and Nonresidents of Switzerland

Swiss bank accounts are not exclusively reserved for Swiss nationals; they are accessible to nonresidents as well. However, nonresidents often face additional requirements, such as higher minimum balance thresholds. Understanding these criteria is essential for nonresidents looking to open an account, as it impacts their ability to maintain and utilize the account efficiently.

Nonresidents may also need to provide additional financial information and documentation to satisfy Swiss banks’ requirements. These include but are not limited to a detailed financial biography, which outlines how the individual has acquired their wealth. This thorough verification process enhances security and ensures that Swiss banks maintain their reputable standing in the international financial community.

Benefits of Swiss Bank Accounts

The allure of Swiss bank accounts lies in their unparalleled privacy, asset protection, and regulatory stability. Unlike banks in many other countries, Swiss banks are bound by a strict banking secrecy law that helps safeguard client confidentiality. This law has been modified to cooperate with global transparency standards but still provides greater privacy than typical international banks.

Moreover, Swiss banks offer a highly sophisticated banking system with a broad range of services tailored to meet individual and corporate needs. These services include wealth management, tax planning, and investment strategies. Swiss banks are renowned for their financial expertise, which can help account holders grow and protect their wealth more effectively.

Frequently Asked Questions (FAQs)

Q1: Can anyone open a Swiss bank account?

Yes, both residents and nonresidents can open a Swiss bank account, provided they meet the bank’s criteria and regulatory requirements.

Q2: Is it legal to hold a Swiss bank account?

Yes, it is completely legal to hold a Swiss bank account as long as individuals comply with tax regulations and declare the account as required in their home country.

Q3: What is the minimum balance for a Swiss bank account?

The minimum balance requirement varies widely among banks and account types, ranging from thousands to millions of dollars.

How Do You Open a Swiss Bank Account?

Opening a Swiss bank account entails selecting a bank, providing necessary documentation, and, in many cases, attending an in-person meeting. The documentation usually includes a valid passport, proof of residence, and proof of the origin of funds. These stringent requirements ensure that the bank complies with international financial regulations.

The process might be daunting for some; therefore, many prospective account holders engage professional intermediaries specializing in Swiss banking. These professionals facilitate the process by offering insights and assistance in meeting bank requirements, making it easier for clients to navigate the Swiss banking landscape.

Can You Hide Money in a Swiss Bank Account?

The notion of hiding money in Swiss bank accounts is a common misconception stemming from their historical reputation for secrecy. While Swiss banks offer privacy, they comply with international transparency standards such as the Common Reporting Standard (CRS). This standard mandates the automatic exchange of financial information with tax authorities worldwide.

Therefore, Swiss bank accounts cannot be used to illegally hide assets or avoid taxation. Transparency laws ensure that account holders must report their Swiss accounts to their respective tax authorities, maintaining legal and ethical banking practices.

How Much Does a Swiss Bank Account Cost?

The cost of maintaining a Swiss bank account can vary significantly depending on the type and services provided. Basic accounts might have lower fees but come with higher minimum balance requirements, often ranging between CHF 5,000 and CHF 100,000, depending on the bank.

Premium accounts offering extensive services like wealth management and investment advice might incur additional fees and necessitate higher balances, sometimes extending up to several million CHF. Prospective account holders must weigh the benefits against the costs to determine the best fit for their financial needs.

The Bottom Line

Understanding Swiss bank minimum balance requirements and associated costs is essential for those considering opening an account. While the prestige and security of Swiss banks are undoubtedly appealing, they come with financial obligations and regulatory compliance that all potential account holders must be prepared to meet.

Key Takeaways

- Swiss bank accounts offer unparalleled privacy and asset protection but require rigorous regulatory compliance.

- Nonresidents can open accounts but may face additional documentation and higher minimum balance requirements.

- Fees and minimum balances vary; understanding these is crucial for making an informed decision.

| Aspect | Details |

|---|---|

| Eligibility | Available to residents and nonresidents subject to documentation and compliance. |

| Secrecy | Offers privacy but complies with international transparency standards like CRS. |

| Costs | Varies by bank and services, with higher minimum balances for premium accounts. |

| Benefits | Includes privacy, asset protection, and financial expertise for account management. |