Opening a Swiss Bank Account from the US

Swiss bank accounts have long been synonymous with wealth and privacy. For individuals in the U.S., opening a Swiss bank account can be an attractive option for asset diversification, financial security, and privacy. This article details the process of opening a Swiss bank account from the U.S., the benefits such accounts provide, and addresses common misconceptions. We’ll explore the necessary requirements, costs involved, and discuss the legalities surrounding Swiss bank accounts for nonresidents. Through this comprehensive guide, potential account holders will be well-informed about entering the world of Swiss banking.

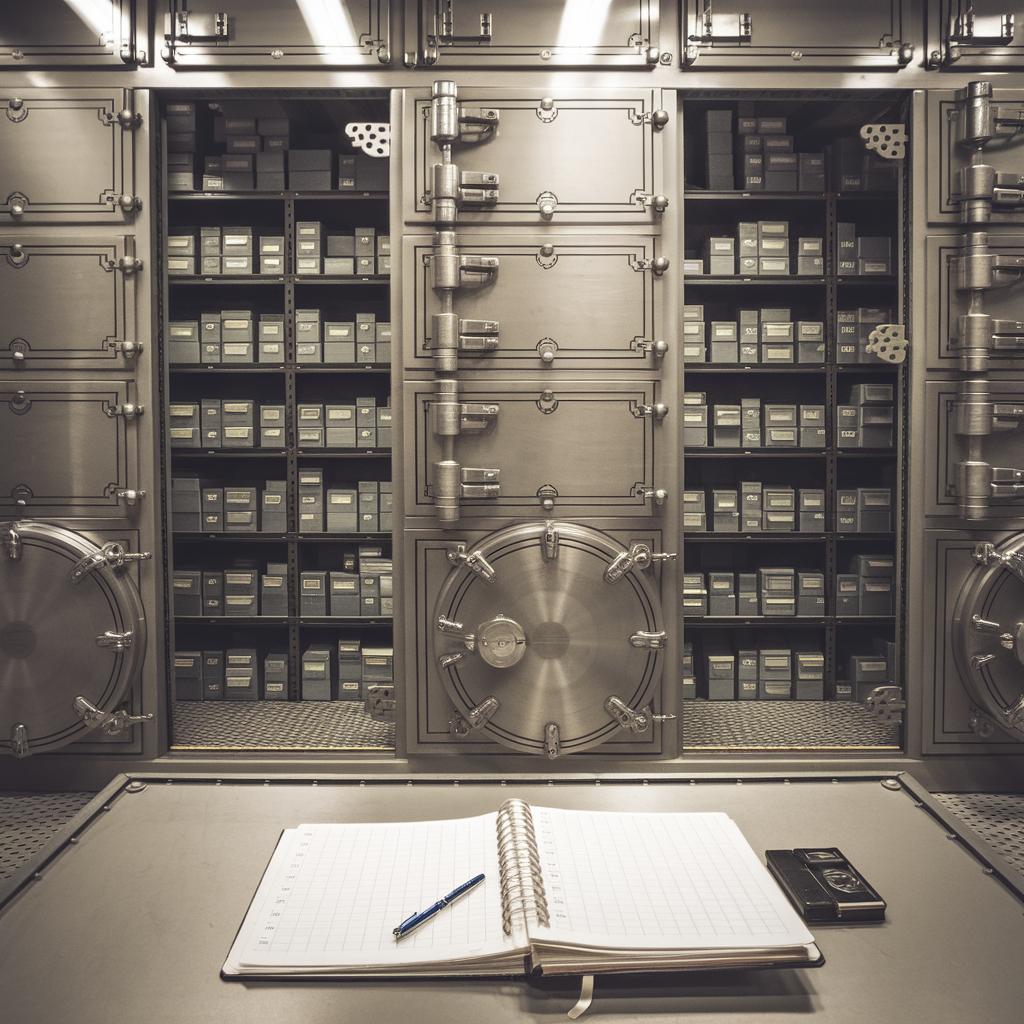

Opening a Swiss Bank Account

Swiss bank accounts carry a sense of exclusivity and are often thought to be reserved for the wealthy elite. However, the process of opening such an account is more accessible than one might imagine, even for residents of the United States. This exploration begins with understanding the steps and criteria involved.

Individuals looking to open a Swiss bank account must first research and select a bank that fits their financial needs. Various Swiss institutions offer accounts tailored for international clients, with services ranging from basic savings accounts to complex investment portfolios.

How Do You Open a Swiss Bank Account?

The process of opening a Swiss bank account typically starts with filling out an application either online or in person. Many banks now offer online services, making it easier for international clients. Applicants will need to provide personal identification documents, such as a passport, proof of address, and other financial details.

One of the critical elements in the process is complying with the bank’s compliance measures. Swiss banks adhere to stringent anti-money laundering (AML) laws, requiring potential clients to demonstrate the legitimacy of their funds. This involves providing financial history, source of income, and sometimes references.

Benefits of Swiss Bank Accounts

Swiss bank accounts are lauded for their privacy and discretion. Switzerland has strict banking secrecy laws that protect the identity and information of account holders. This level of confidentiality is appealing to those seeking privacy in their financial dealings.

In addition to privacy, Swiss banks are known for their stability. Switzerland’s political and economic climate is stable, making its banks safe havens for assets. This makes Swiss bank accounts particularly attractive for those wishing to protect their wealth from economic instability in their home countries.

Swiss Bank Accounts and Nonresidents of Switzerland

Nonresidents, including U.S. citizens, can open Swiss bank accounts; however, they must meet specific requirements and undergo scrutiny. Swiss banks are highly regulated and must adhere to international standards, which ensure they do not harbor illicit funds.

Nonresident account holders need to be aware of their country’s tax laws. In the U.S., citizens must declare foreign bank accounts and any interest earned to the IRS. Failure to do so can result in serious penalties. Swiss banks comply with international tax regulations and often report account information to foreign tax authorities as required.

Can You Hide Money in a Swiss Bank Account?

The perception that Swiss bank accounts can be used to hide money is largely outdated. While privacy is a feature, Swiss banks have stringent regulations and transparency agreements with international tax authorities.

Modern banking regulations and agreements such as the Foreign Account Tax Compliance Act (FATCA) have curtailed opportunities for tax evasion. Swiss banks now routinely share account information with U.S. tax authorities, thus negating the possibility of legally hiding money.

How Much Does a Swiss Bank Account Cost?

Opening a Swiss bank account involves costs that may include a one-time setup fee and ongoing maintenance fees. These fees can vary significantly based on the financial institution and the type of account.

Prospective account holders should carefully evaluate the fee structures of different banks in Switzerland. Additionally, they should consider currency exchange rates, as transactions, deposits, and withdrawals may incur currency conversion costs if the account is in Swiss francs.

Frequently Asked Questions (FAQs)

Q: Is it legal for a U.S. citizen to have a Swiss bank account?

A: Yes, it is legal, provided that the account is declared to the IRS and all income is reported.

Q: How much money is needed to open a Swiss bank account?

A: The amount varies by bank. Some require a minimum deposit, which could range from a few thousand to several hundred thousand dollars.

Q: Are there any taxes on Swiss bank accounts?

A: While Switzerland does not tax foreign income in Swiss bank accounts, U.S. citizens must declare those accounts and any earnings to the IRS.

Key Takeaways

Swiss bank accounts offer privacy, stability, and potential tax advantages. While opening an account involves a straightforward process, nonresidents must ensure compliance with international and domestic financial regulations. Understanding the costs involved and the transparency in modern Swiss banking are crucial for prospective account holders.

The Bottom Line

| Topic | Summary |

|---|---|

| Opening a Swiss Bank Account | Research and select a suitable bank, provide necessary documentation, and comply with legal regulations. |

| Benefits | Privacy, stability, and jurisdictional advantages make Swiss bank accounts appealing. |

| Nonresident Accounts | U.S. citizens can open accounts but must comply with both Swiss and U.S. tax laws. |

| Hiding Money | Modern Swiss banking regulations make it difficult to hide money legally. |

| Costs | Opening and maintaining a Swiss bank account can involve significant fees. |

| Key Takeaways | Swiss bank accounts offer unique benefits but require compliance with global financial regulations. |